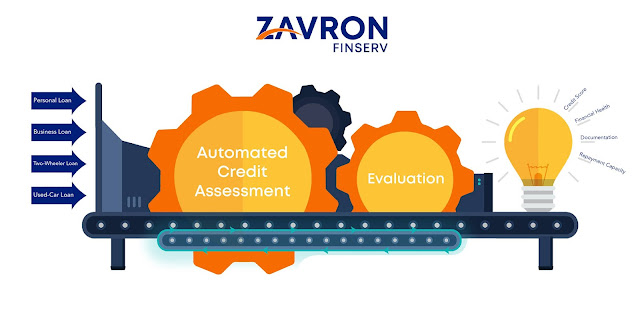

How Automated Credit Assessment and Evaluation is better and efficient?

Better and efficient lending demands a proper, error-free credit assessment. The credit assessment depends on a number of factors including the type of loan, credit score, financial health, repayment capacity and documentation. All of this requires a close look and an error-free procedure for further acceleration.

Over the years, the traditional credit scoring has seen a

shift and lenders are turning to technology to automate their processes and its

related decisions. With consumers expecting the credit evaluation and loan

application process in real time, fintech

and banks turned to digitization. In this article, we will have a close look at

what is credit assessment and how it has changed over the years in contrast to

traditional credit assessment process.

What is credit assessment?

Credit assessment or credit analysis as it is popularly known

is a method to check the creditworthiness of the borrower (an individual or a

company). This process involves the overall assessment of loan application,

financial health and sufficiency of the cash flow. The credit assessment is

done on the basis of details provided by the loan applicant in the application

and documents submitted by them for verification which may include KYC

Documents, Bank statements, credit score, cash flow reports, etc.

How has automation made credit assessment better?

Technology has brought a lot of substantial changes in the

banking, especially lending system. The inclusion of digital channels has made

the lending process smoother and easier. Here are a few factors that have

improved due to automation of the credit assessment.

- Accurate

The analytical and objective credit rating systems adopted by

the lending companies enhance the credit assessment process by assessing

accurate facilitators. The decision making becomes quicker and efficient with

integrated credit systems and sources at work by ruling out scope of missing

documents since the scanned copies are provided handy to the lenders for

verification digitally.

- Continuous and consistent improvement

The data and analytics in automated credit assessment systems

is continuously and consistently upgrading and updating. The underwriting

process becomes easier when you have a tool to analyse your borrowers’ needs

and provide them with the best loan opportunities with reduced risk and a base

to fall back to continuously improve loan disbursal efficiency.

- No scope of human error

The biggest advantage anyone can think of with automated

credit assessment systems is that the manual involvement is substantially

reduced. Apart from entering the basic details, the assessment is carried out

without any human intervention. This leads to reduced and minimized scope of

errors from a human being, making process seamless and hassle free.

- Reduced Delay

The traditional way of analyzing credit worthiness of any

potential borrower was via various manual channels. The borrower had to

literally wait for days before he/she could get an approval on loan, with

technology and digitization in credit assessment, the process has accelerated

manifolds and the approvals can be sent within a few minutes or hours depending

on the digital presence of the borrower.

- Multichannel

Technology diminishes the manual work related with warnings. A digitized credit handling framework assists money lenders with making an assortment of warning formats that are then populated with candidate and advance explicit data prior to sending the notice. Multichannel correspondence enables loan specialists to send notices by email, print, and even instant messages.

Final words

For lenders who want to provide seamless and quick lending services to its customers, an automated credit assessment system can be a beneficial investment and definitely a way to sustain in a highly competitive market. Millennials these days are tech-savvy and rely on digital channels for every service out there in the world. Any digital lender with such products is bound to see new heights with their consistent and continuous efforts to make process smooth and tech-friendly.

Quick Links:

Instant

Personal Loan | Instant

Business Loan | Used

Car Loan | Two

Wheeler Loan | Apply Now

Comments

Post a Comment