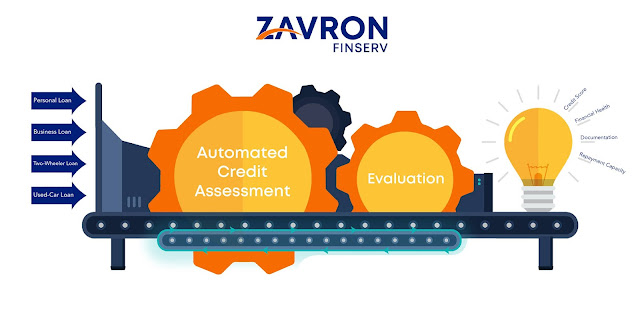

How Automated Credit Assessment and Evaluation is better and efficient?

Better and efficient lending demands a proper, error-free credit assessment. The credit assessment depends on a number of factors including the type of loan , credit score, financial health, repayment capacity and documentation. All of this requires a close look and an error-free procedure for further acceleration. Over the years, the traditional credit scoring has seen a shift and lenders are turning to technology to automate their processes and its related decisions. With consumers expecting the credit evaluation and loan application process in real time, fintech and banks turned to digitization. In this article, we will have a close look at what is credit assessment and how it has changed over the years in contrast to traditional credit assessment process. What is credit assessment? Credit assessment or credit analysis as it is popularly known is a method to check the creditworthiness of the borrower (an individual or a company). This process involves the overall assessment o...